Stocks, bonds, and other investment options play a crucial role in a diversified investment portfolio. Understanding these financial instruments is essential for anyone looking to grow their wealth and achieve financial goals. This guide will provide an in-depth look at the characteristics, benefits, and risks associated with each type of investment.

Understanding Stocks

Overview: Stocks represent ownership in a company. When you purchase a stock, you are buying a small piece of that company, making you a shareholder. Stocks are a popular investment choice due to their potential for high returns.

Key Characteristics:

- Equity Ownership: Owning stocks means you have a claim on part of the company’s assets and earnings.

- Dividends: Some companies pay dividends, which are a portion of the profits distributed to shareholders.

- Capital Gains: Stocks can increase in value over time, allowing investors to sell them at a higher price than they were purchased.

Benefits:

- High Return Potential: Historically, stocks have offered higher returns compared to other investment options.

- Liquidity: Stocks can be easily bought and sold on the stock market.

- Dividend Income: Dividend-paying stocks provide a steady income stream in addition to potential capital gains.

Risks:

- Market Volatility: Stock prices can fluctuate widely due to market conditions, economic factors, and company performance.

- Loss of Capital: There is a risk of losing your investment if the company performs poorly.

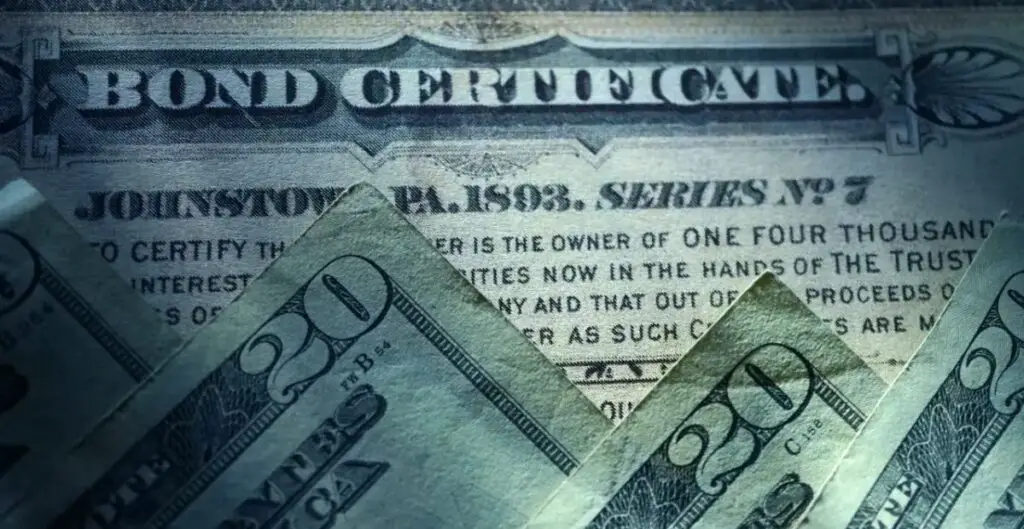

Understanding Bonds

Overview: Bonds are debt securities issued by governments, municipalities, and corporations to raise capital. When you buy a bond, you are lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity.

Key Characteristics:

- Fixed Income: Bonds pay regular interest, known as coupon payments, to bondholders.

- Maturity Date: Bonds have a specific maturity date, at which point the principal amount is repaid.

- Credit Rating: Bonds are rated based on the issuer’s creditworthiness, affecting the interest rate and risk level.

Benefits:

- Predictable Income: Bonds provide a steady stream of income through regular interest payments.

- Lower Risk: Bonds are generally considered less risky than stocks, especially government bonds.

- Diversification: Adding bonds to your portfolio can help balance risk and reduce volatility.

Risks:

- Interest Rate Risk: Bond prices can decline when interest rates rise.

- Credit Risk: There is a risk that the bond issuer may default on interest payments or fail to repay the principal.

- Inflation Risk: Inflation can erode the purchasing power of bond interest payments.

Other Investment Options

Overview: In addition to stocks and bonds, there are various other investment options available, each with its own set of characteristics, benefits, and risks.

Mutual Funds

Overview: Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers.

Benefits:

- Diversification: Mutual funds provide instant diversification, reducing risk.

- Professional Management: Funds are managed by experienced professionals.

- Accessibility: Mutual funds are easy to buy and sell, often with low minimum investment requirements.

Risks:

- Management Fees: Mutual funds charge management fees, which can eat into returns.

- Market Risk: The value of mutual fund shares can fluctuate with the market.

Exchange-Traded Funds (ETFs)

Overview: ETFs are similar to mutual funds but trade like stocks on an exchange. They typically track an index, commodity, or a basket of assets.

Benefits:

- Liquidity: ETFs can be bought and sold throughout the trading day at market prices.

- Low Fees: ETFs generally have lower expense ratios compared to mutual funds.

- Diversification: Like mutual funds, ETFs offer diversification across a range of assets.

Risks:

- Market Risk: ETF prices can be affected by market fluctuations.

- Trading Costs: Buying and selling ETFs can incur brokerage fees.

Real Estate

Overview: Investing in real estate involves purchasing property to generate rental income or for capital appreciation. Real estate can be a tangible and lucrative investment option.

Benefits:

- Income Generation: Rental properties provide a steady income stream.

- Appreciation: Real estate can appreciate in value over time.

- Tax Benefits: Investors can benefit from tax deductions related to property expenses.

Risks:

- Liquidity: Real estate is less liquid compared to stocks and bonds.

- Market Risk: Property values can decline due to economic conditions.

- Management: Owning property requires ongoing management and maintenance.

Commodities

Overview: Commodities include physical assets like gold, silver, oil, and agricultural products. Investors can gain exposure to commodities through futures contracts, ETFs, or direct ownership.

Benefits:

- Diversification: Commodities can provide diversification to a portfolio.

- Inflation Hedge: Commodities often perform well during periods of inflation.

Risks:

- Volatility: Commodity prices can be highly volatile.

- Storage and Transport: Physical commodities require storage and transportation.

Creating a Diversified Portfolio

Overview: Diversification involves spreading your investments across different asset classes to reduce risk. A well-diversified portfolio can help you achieve more stable returns.

Steps:

- Assess Risk Tolerance: Determine your risk tolerance based on your financial goals, time horizon, and comfort level with market fluctuations.

- Allocate Assets: Allocate your investments among stocks, bonds, and other asset classes based on your risk tolerance.

- Rebalance Regularly: Periodically review and adjust your portfolio to maintain your desired asset allocation.

FAQs About Stocks, Bonds, and Other Investment Options

- What are stocks?

- Stocks represent ownership in a company, providing potential for capital gains and dividend income.

- What are bonds?

- Bonds are debt securities issued by entities to raise capital, offering regular interest payments and return of principal at maturity.

- What is the difference between stocks and bonds?

- Stocks offer equity ownership and potential for high returns, while bonds provide fixed income and lower risk.

- What are mutual funds?

- Mutual funds pool money from investors to buy a diversified portfolio of securities, managed by professionals.

- What are ETFs?

- ETFs are similar to mutual funds but trade like stocks, offering diversification and low fees.

- How can I invest in real estate?

- You can invest in real estate by purchasing rental properties, REITs, or real estate-focused ETFs.

- What are commodities?

- Commodities are physical assets like gold, oil, and agricultural products that can be traded or invested in through various means.

- Why is diversification important?

- Diversification reduces risk by spreading investments across different asset classes, leading to more stable returns.

- How do I determine my risk tolerance?

- Assess your financial goals, investment horizon, and comfort with market volatility to determine your risk tolerance.

- What is a diversified portfolio?

- A diversified portfolio includes a mix of different asset classes, such as stocks, bonds, and real estate, to reduce risk.